Navigating Complexity: A Comprehensive Analysis of Financial Advisory Services for Expatriates in the United Kingdom

Navigating Complexity: A Comprehensive Analysis of Financial Advisory Services for Expatriates in the United Kingdom

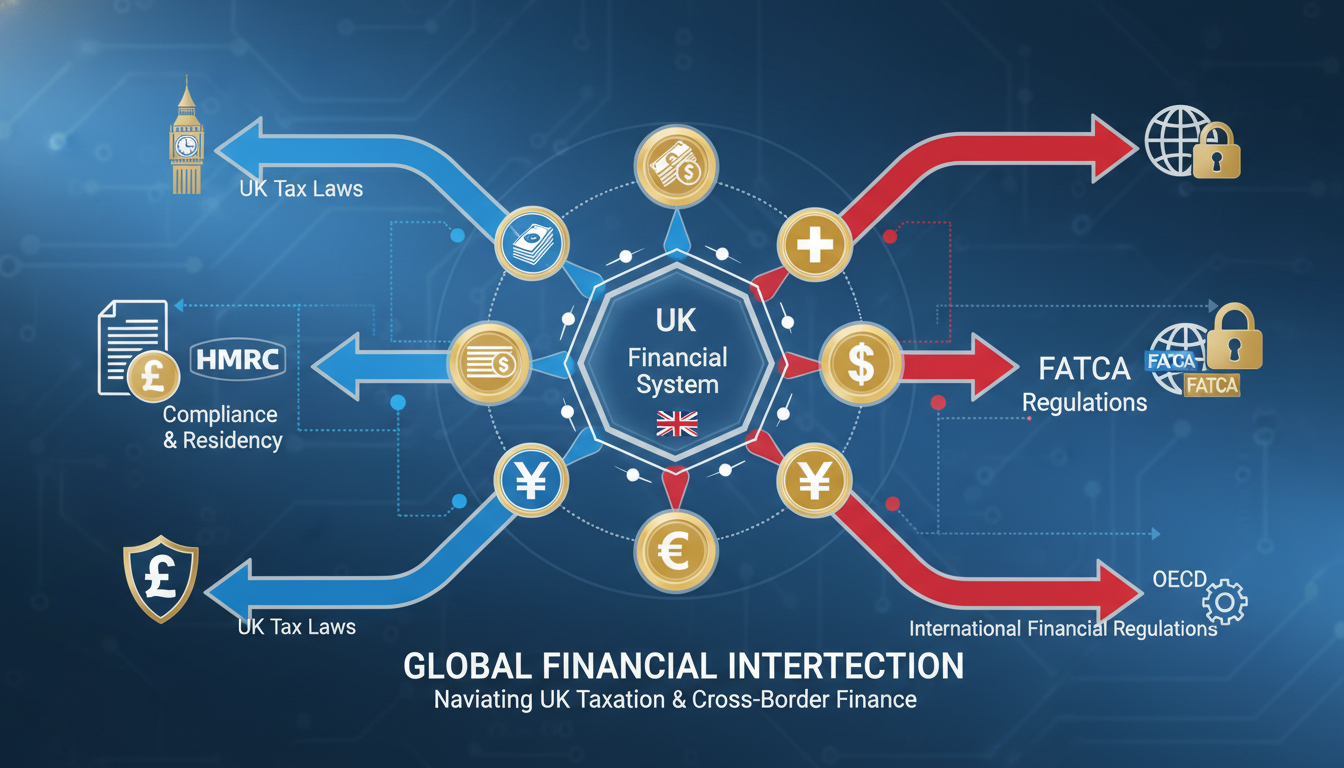

Relocating to the United Kingdom presents a multifaceted array of financial considerations that extend far beyond simple currency conversion or local banking. For expatriates, the UK’s financial landscape is a dense thicket of regulatory requirements, intricate tax codes, and cross-border obligations. Consequently, the role of a specialized financial advisor becomes not merely beneficial but essential for the preservation and growth of wealth. This article examines the critical importance of financial advisors for expats in the UK, the specific challenges they address, and the criteria for selecting competent professional guidance.

The Regulatory Framework and Professional Standards

The United Kingdom maintains one of the most rigorous financial regulatory environments in the world. The Financial Conduct Authority (FCA) is the primary body overseeing financial services firms and individual practitioners. For expatriates, it is imperative to engage with advisors who are not only FCA-regulated but also possess specific expertise in international financial planning. Academic rigor in this field is marked by qualifications from the Chartered Institute for Securities & Investment (CISI) or the Personal Finance Society (PFS).

Professional financial advisors for expats must navigate the intersection of UK domestic law and the fiscal regulations of the client’s home country. This dual-jurisdiction awareness is what differentiates a standard financial planner from an expatriate specialist. The former may understand the nuances of an Individual Savings Account (ISA), while the latter understands how that ISA is treated by the Internal Revenue Service (IRS) in the United States or the Finanzamt in Germany.

The Critical Dichotomy: Residency versus Domicile

One of the most profound challenges facing expatriates in the UK is the legal distinction between ‘residency’ and ‘domicile.’ While residency is generally determined by the number of days spent in the country (the Statutory Residence Test), domicile is a more permanent concept, often linked to one’s country of birth or long-term intentions.

Financial advisors play a pivotal role in explaining the ‘remittance basis’ of taxation. For non-domiciled individuals (non-doms), there may be opportunities to shield foreign income and gains from UK taxation, provided these funds are not brought into the UK. However, recent legislative shifts have significantly altered the landscape for long-term residents. An advisor’s ability to conduct a ‘remittance basis’ cost-benefit analysis is crucial, as the wrong decision can lead to substantial tax liabilities or the loss of personal allowances.

Pension Portability and Retirement Planning

Retirement planning for expatriates is rarely a linear process. Many individuals arrive in the UK with existing pension structures, such as 401(k)s, IRAs, or European state pensions. Conversely, those planning to leave the UK must decide what to do with their accumulated UK pension wealth.

Advisors specialized in expat finance often deal with Qualifying Recognised Overseas Pension Schemes (QROPS) and Self-Invested Personal Pensions (SIPPs). The decision to transfer a pension is fraught with risk, including potential ‘unauthorised payment’ charges and currency fluctuations. A specialized advisor provides the mathematical modeling necessary to determine whether a transfer is mathematically advantageous or if the client is better served by maintaining a frozen scheme in their previous jurisdiction.

Investment Strategy and Cross-Border Compliance

Investment management for expatriates requires a high degree of sensitivity to tax-efficient structures. For example, US citizens residing in the UK face unique hurdles due to the Foreign Account Tax Compliance Act (FATCA) and the UK’s own reporting requirements. Many standard UK investment funds are classified as Passive Foreign Investment Companies (PFICs) by the IRS, which can result in punitive taxation for US citizens.

Specialized advisors ensure that portfolios are constructed using ‘reporting funds’ that satisfy both UK and home-country tax authorities. Furthermore, they address currency risk—a factor often overlooked by domestic advisors. An expat’s liabilities may be in Pounds Sterling, but their long-term goals might be in Euros or Dollars. Hedging strategies and multi-currency portfolio management are therefore core components of the advisory process.

Estate Planning and Inheritance Tax (IHT)

The UK’s Inheritance Tax (IHT) regime is notoriously wide-reaching. For those deemed domiciled in the UK, their worldwide estate is subject to IHT at a rate of 40% above the nil-rate band. For non-domiciled individuals, only their UK-sited assets are typically within the scope of IHT, but this changes once they have been resident for 15 out of the previous 20 tax years.

Financial advisors assist in the implementation of trusts, life insurance policies, and gifting strategies to mitigate this exposure. Without professional intervention, an expatriate’s heirs may find a significant portion of their legacy consumed by the state, often in multiple jurisdictions if double-taxation treaties are not correctly invoked.

The Selection Process: What to Look For

When selecting a financial advisor, expatriates should prioritize the following criteria:

1. FCA Authorization: Verify the advisor’s status on the Financial Services Register.

2. Specialization: Ensure the advisor has experience with your specific nationality and the associated tax treaties.

3. Fee Transparency: Academic and ethical standards dictate a clear disclosure of fees—whether they are fixed, hourly, or a percentage of assets under management (AUM). Avoid advisors who rely solely on commissions from financial products.

4. Technological Integration: In a globalized world, the ability to access portfolios and communicate securely through digital portals is a necessity.

Conclusion

The financial journey of an expatriate in the United Kingdom is characterized by both opportunity and peril. The intricacies of the UK tax system, combined with the complexities of international compliance, necessitate a level of expertise that exceeds the capabilities of most individual investors. By engaging a specialized financial advisor, expatriates can ensure that their wealth is managed with technical precision, tax efficiency, and a long-term strategic vision. In the final analysis, the cost of professional advice is frequently dwarfed by the value of the tax savings and risk mitigation it provides, making it an indispensable investment for any global citizen calling the UK home.