Navigating the Complexities of US-UK Double Taxation: A Comprehensive Guide for Expatriates

Navigating the Complexities of US-UK Double Taxation: A Comprehensive Guide for Expatriates

For American citizens residing in the United Kingdom, the financial landscape is defined by a unique and often burdensome intersection of two distinct tax jurisdictions. The United States is one of the few nations globally that employs a citizenship-based taxation system, meaning that US citizens and Green Card holders are subject to federal income tax on their worldwide income, regardless of where they live or where the income is earned. When combined with the United Kingdom’s residency-based taxation, the potential for double taxation becomes a significant concern. This article provides an academic and technical overview of the mechanisms available to mitigate these liabilities, the role of the US-UK Tax Treaty, and the critical reporting requirements for expats.

The Jurisdictional Conflict: Citizenship vs. Residency

To understand the necessity of double taxation advice, one must first recognize the conflicting mandates of the Internal Revenue Service (IRS) and HM Revenue and Customs (HMRC). The US asserts its right to tax based on the Fourteenth Amendment and the Internal Revenue Code (IRC), while the UK determines tax liability based on the Statutory Residence Test (SRT).

Most US expats in the UK find themselves classified as UK tax residents. Under the ‘arising basis’ of taxation, the UK taxes their global income. Simultaneously, the US expects a full accounting of that same income. Without intervention, an individual could theoretically face effective tax rates exceeding 70% on certain types of income.

[IMAGE_PROMPT: A professional office setting in London with a view of the City skyline, featuring a desk with a calculator, a US passport, and various financial documents labeled IRS and HMRC, emphasizing the intersection of two legal systems.]

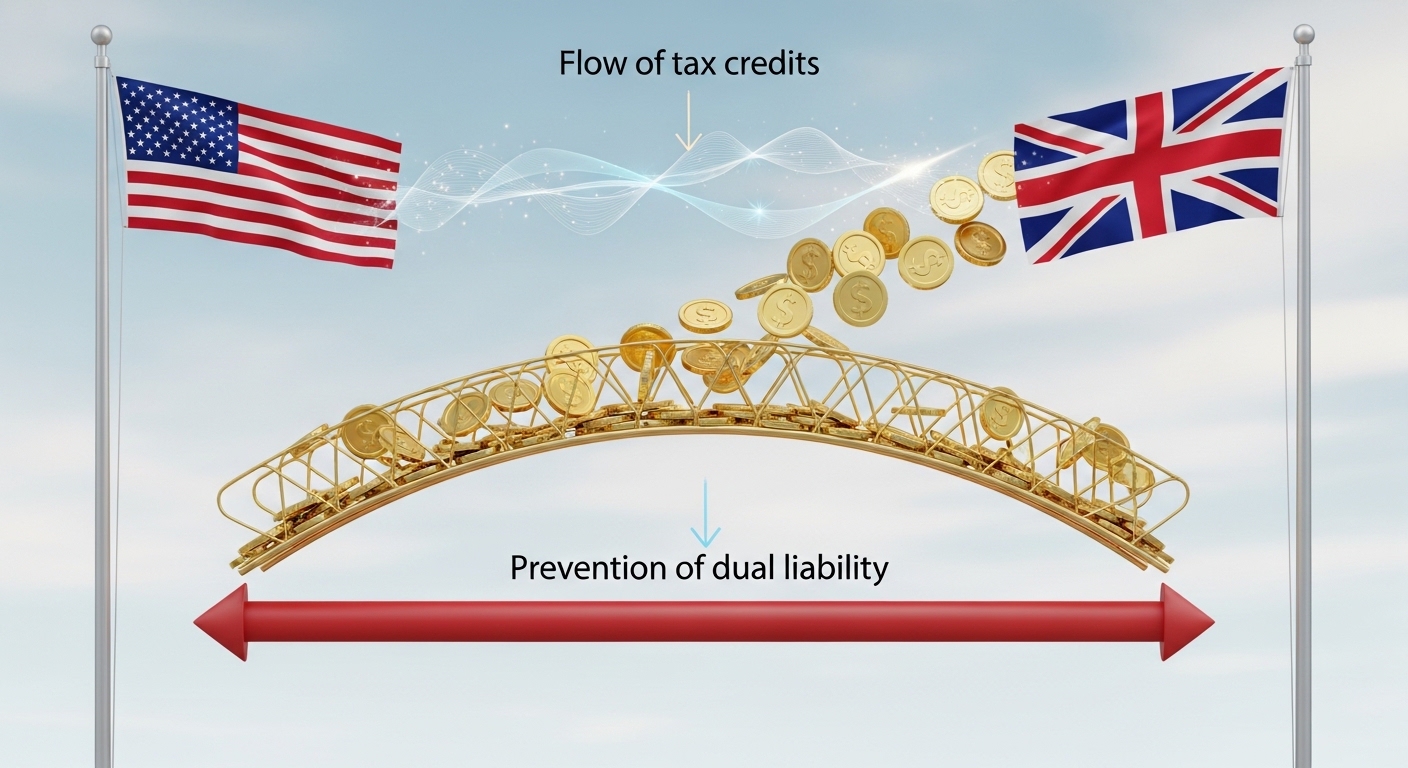

The Role of the US-UK Income Tax Treaty

The primary instrument for avoiding double taxation is the Convention between the Government of the United States of America and the Government of the United Kingdom of Great Britain and Northern Ireland for the Avoidance of Double Taxation (the “Treaty”). Signed in 2001 and subsequently amended, the Treaty provides “tie-breaker” rules to determine which country has the primary taxing right over specific categories of income, such as dividends, interest, royalties, and pensions.

However, a critical nuance often overlooked by laypeople is the “Saving Clause” (Article 1, Paragraph 4). This clause allows the US to tax its citizens as if the Treaty had not come into effect. While there are specific exceptions to the Saving Clause (such as provisions regarding social security and certain pension contributions), it generally means that US citizens cannot use the Treaty to avoid US tax on income that the US has the right to tax under domestic law.

Principal Relief Mechanisms: FEIE and FTC

To prevent actual double taxation, the US provides two primary legislative reliefs: the Foreign Earned Income Exclusion (FEIE) and the Foreign Tax Credit (FTC).

1. Foreign Earned Income Exclusion (Form 2555)

The FEIE allows expats to exclude a specific amount of foreign-earned wages or self-employment income from US taxation ($120,000 for the 2023 tax year). To qualify, the taxpayer must pass either the Physical Presence Test or the Bona Fide Residence Test. While effective, the FEIE does not apply to passive income (interest, dividends, or capital gains) and may limit the taxpayer’s ability to claim certain credits, such as the Additional Child Tax Credit.

2. Foreign Tax Credit (Form 1116)

The FTC is often more beneficial for US expats in the UK due to the UK’s generally higher income tax rates. Under this mechanism, the US allows a dollar-for-dollar credit for income taxes paid to the UK. Because UK tax rates (20%, 40%, and 45%) usually exceed US federal rates, the FTC often reduces the US tax liability on UK-sourced income to zero. Any excess credits can be carried back one year or forward for up to ten years.

Pension Considerations and the SIPP/401(k) Dilemma

Pensions represent one of the most complex areas of US-UK tax planning. Article 18 of the Treaty generally allows for the tax-deferred growth of pensions. Contributions to a UK employer-sponsored pension may be deductible on a US tax return, provided the plan is “recognized” under the Treaty.

However, Individual Savings Accounts (ISAs) and certain UK collective investment schemes (OEICs or Unit Trusts) are problematic. The IRS views most non-US mutual funds as Passive Foreign Investment Companies (PFICs). PFICs are subject to a highly punitive tax regime under the US tax code, involving the highest marginal tax rates and interest charges on deferred distributions. Consequently, US expats are generally advised to avoid ISAs in favor of US-compliant investment vehicles or specific pension structures like SIPPs (Self-Invested Personal Pensions), though the latter requires careful navigation of the Treaty’s limitations.

The Burden of Disclosure: FBAR and FATCA

Beyond the payment of taxes, US expats face rigorous reporting requirements. Under the Bank Secrecy Act, any US person with a financial interest in or signature authority over foreign financial accounts exceeding $10,000 at any time during the calendar year must file FinCEN Form 114, also known as the Foreign Bank and Financial Accounts Report (FBAR).

Additionally, the Foreign Account Tax Compliance Act (FATCA) requires the filing of Form 8938 if foreign financial assets exceed certain thresholds (starting at $200,000 for single taxpayers living abroad). Failure to comply with these disclosure requirements can result in draconian penalties, often starting at $10,000 per violation, regardless of whether any tax was actually owed.

[IMAGE_PROMPT: A detailed close-up of a digital tablet screen displaying a complex tax form (Form 1116) and a magnifying glass resting on a stack of financial spreadsheets, symbolizing the meticulous nature of US tax compliance.]

Conclusion: The Necessity of Proactive Planning

The intersection of US and UK tax law is a minefield for the unwary. While the US-UK Tax Treaty and internal relief mechanisms like the Foreign Tax Credit provide the tools necessary to avoid paying tax twice, the administrative burden of compliance is immense. For the American expatriate, the goal is not merely to avoid double taxation but to optimize their global tax position while remaining fully compliant with the reporting mandates of both the IRS and HMRC.

Given the frequent changes in tax legislation—such as the recent shifts in UK’s non-domicile status rules and evolving US tax reform—seeking professional advice from cross-border tax specialists is not merely recommended; it is essential for long-term financial security. By understanding the mechanics of these treaties and credits, expats can navigate their time in the UK without the looming shadow of an unresolved tax crisis.