#

Introduction

The United Kingdom (UK) continues to be a premier destination for global entrepreneurs seeking a stable, transparent, and innovative environment to launch and scale their commercial ventures. However, for expatriates, the transition from an idea to a legally operating entity involves navigating a multifaceted regulatory framework that spans immigration law, corporate governance, and fiscal obligations. Understanding these legal requirements is not merely a matter of compliance but a fundamental prerequisite for long-term operational sustainability. This article provides an academic and comprehensive overview of the essential legal steps and considerations for foreign nationals intending to establish a business presence in the UK.

1. Navigating Immigration and Work Authorization

The primary hurdle for any expat entrepreneur is securing the legal right to work and manage a business within the UK. Since the conclusion of the Brexit transition period, the UK has implemented a points-based immigration system that treats EU and non-EU citizens equally. For those intending to start a new business, the Innovator Founder Visa is the most prominent pathway. This route requires the applicant to have a business plan that is ‘innovative, viable, and scalable,’ which must be endorsed by an approved body. Notably, the previous requirement for a minimum investment of £50,000 has been removed for most applicants, though the scrutiny of the business model’s uniqueness remains rigorous.

Alternatively, for established foreign companies seeking to expand their operations into the UK, the UK Expansion Worker Visa (part of the Global Business Mobility route) allows senior managers or specialist employees to facilitate the setup of a first branch or subsidiary. It is crucial to note that one cannot simply enter the UK on a Standard Visitor Visa and begin active business management; doing so constitutes a breach of immigration rules and can lead to deportation and future entry bans.

2. Selecting a Legal Business Structure

Choosing the appropriate legal vehicle is a decision with significant implications for liability, taxation, and administrative burden. Expats typically choose between three primary structures:

- Sole Trader: This is the simplest form of business. However, for expats, it may present challenges regarding visa eligibility and personal liability. In this structure, there is no legal distinction between the individual and the business, meaning the owner is personally responsible for all debts.

- Partnership: A traditional partnership involves two or more individuals sharing responsibility. A more sophisticated version is the Limited Liability Partnership (LLP), which offers the flexibility of a partnership while providing the limited liability protection of a corporation. This is often favored by professional service firms.

- Private Limited Company (Ltd): This is the most common choice for expats. A limited company is a separate legal entity from its owners (shareholders). It provides protection for personal assets and is generally seen as more ‘bankable’ by UK financial institutions. However, it comes with stricter reporting requirements to Companies House.

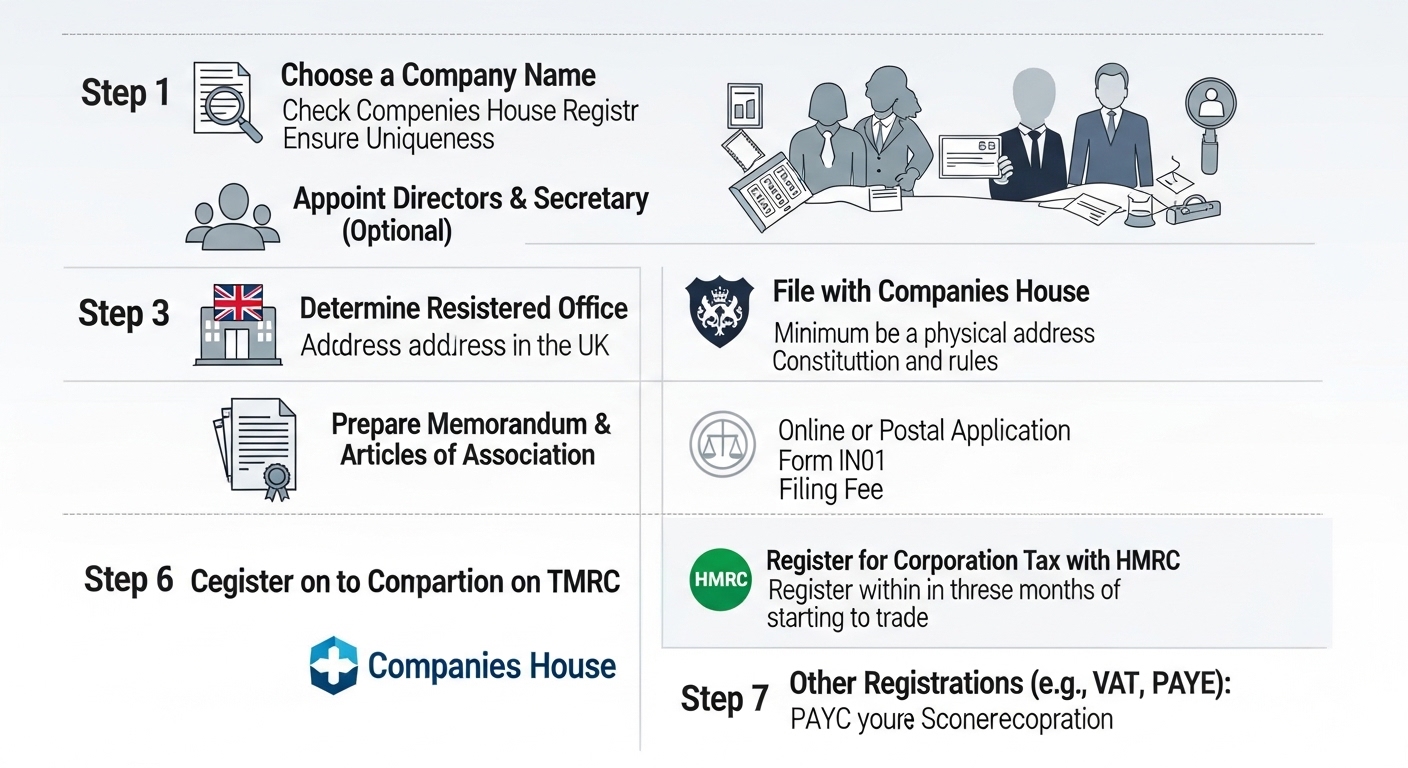

- Corporation Tax: Limited companies are subject to Corporation Tax on their profits. Registration must occur within three months of starting to trade.

- Value Added Tax (VAT): If a business’s taxable turnover exceeds the current threshold (typically £90,000), VAT registration is mandatory. Some businesses choose to register voluntarily even below this threshold to reclaim VAT on business expenses.

- Pay As You Earn (PAYE): If the expat entrepreneur intends to hire employees (including themselves as a director), they must register for PAYE to collect Income Tax and National Insurance contributions from employees’ pay and report them to HMRC.

3. Statutory Registration and Incorporation

For those choosing to incorporate a Limited Company, the process is managed through Companies House. The application must include the ‘Memorandum of Association’ and the ‘Articles of Association,’ which define the company’s internal rules and purpose. Every UK company must have a Registered Office Address located within the UK. This address is where all official government correspondence will be sent and is a matter of public record. For many expats, using a professional service provider’s address is a common strategy to maintain privacy while meeting legal requirements.

4. Fiscal Obligations and HMRC Compliance

Taxation is a complex pillar of the UK legal framework. Every business must register with HM Revenue and Customs (HMRC).

Furthermore, the UK has stringent ‘Anti-Money Laundering’ (AML) and ‘Know Your Customer’ (KYC) regulations. Expats may find that opening a business bank account is the most time-consuming part of the setup, as banks perform deep due diligence on foreign nationals and the source of their investment capital.

5. Intellectual Property and Data Protection

In a modern economy, protecting intangible assets is vital. Registering trademarks, patents, or designs with the Intellectual Property Office (IPO) ensures that the business’s unique identity and innovations are legally protected within the UK jurisdiction.

Concurrently, any business handling personal data must comply with the UK General Data Protection Regulation (UK GDPR) and the Data Protection Act 2018. This involves ensuring that data is processed lawfully, transparently, and securely. Most businesses will also need to register with the Information Commissioner’s Office (ICO) and pay a data protection fee.

6. Employment Law and Insurance

If the expat-owned business grows to include staff, it must adhere to UK employment law, which is highly protective of worker rights. This includes providing written statements of employment, adhering to the National Minimum Wage, and ensuring workplace pension auto-enrolment.

Additionally, Employers’ Liability Insurance is a legal requirement for almost all businesses with employees. This insurance must cover at least £5 million and must be issued by an authorized insurer. Failure to have this insurance can result in fines of up to £2,500 for every day the business is uninsured.

Conclusion

Establishing a business in the United Kingdom as an expatriate is an ambitious endeavor that requires a meticulous approach to legal compliance. From securing the correct visa and choosing a corporate structure to fulfilling HMRC obligations and navigating data protection laws, each step demands careful attention. While the UK offers a business-friendly environment, the penalties for non-compliance are severe. Therefore, it is highly recommended that expat entrepreneurs seek professional legal and tax advice early in the process to ensure their venture is built on a solid and lawful foundation. By adhering to these statutory requirements, foreign entrepreneurs can focus on their core mission: driving innovation and contributing to the vibrant economic landscape of the UK.