Strategic Analysis of UK Residential Property Investment for Expatriates: Opportunities, Legal Frameworks, and Fiscal Implications

#

Introduction

The United Kingdom’s real estate market has historically served as a primary destination for global capital, offering a unique blend of legal transparency, economic stability, and long-term capital appreciation. For expatriates (expats)—individuals residing outside their country of origin—the UK property sector represents more than just a tangible asset; it is a strategic hedge against currency volatility and a vehicle for wealth preservation. However, navigating the complexities of the UK market from abroad requires a nuanced understanding of shifting legislative landscapes, tax obligations, and regional economic performance. This article provides a comprehensive academic inquiry into the current state of UK property investment for expats, detailing the critical factors that influence ROI and risk management.

The Macroeconomic Context: Why the UK Remains Resilient

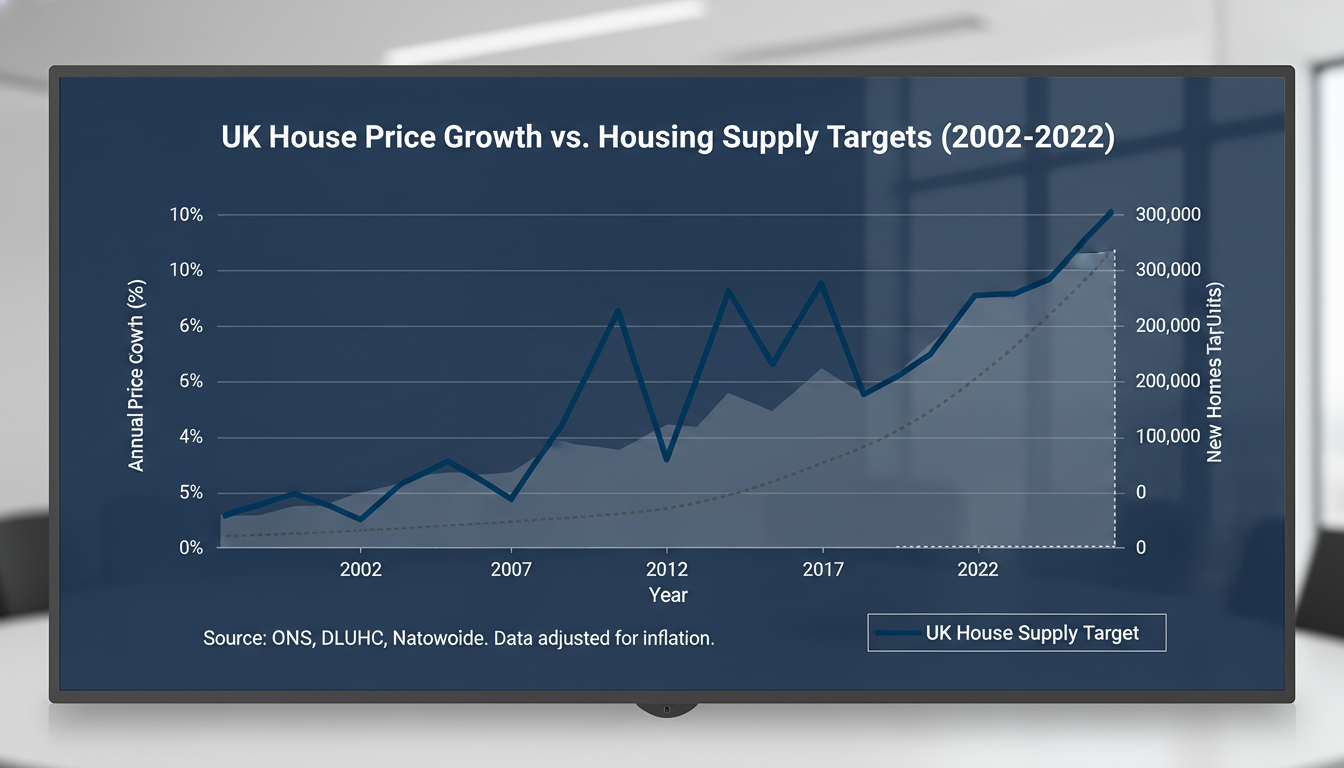

Despite global economic fluctuations, the UK residential market is underpinned by a chronic imbalance between supply and demand. The structural deficit in housing delivery—where the rate of new builds consistently fails to meet government targets—ensures that property values remain supported even during periods of high interest rates. For the expatriate investor, this supply-demand gap provides a ‘margin of safety.’ Furthermore, while the Sterling has experienced volatility following various geopolitical shifts, this has historically created a ‘currency discount’ for investors holding stronger foreign currencies, such as the US Dollar, Euro, or Singapore Dollar, effectively lowering the barrier to entry into prime and secondary UK markets.

Legislative and Regulatory Frameworks

One of the most significant hurdles for expatriates is the evolving regulatory environment. In recent years, the UK government has introduced measures to dampen speculative investment and prioritize domestic owner-occupiers. The most notable of these is the Stamp Duty Land Tax (SDLT) surcharge. For non-residents, an additional 2% surcharge is applied on top of the standard SDLT rates and the 3% additional dwelling supplement. This fiscal measure necessitates a longer-term investment horizon to amortize initial acquisition costs.

Moreover, the legal distinction between ‘Freehold’ and ‘Leasehold’ properties is a concept often unfamiliar to international investors. While most houses are sold as freehold (absolute ownership of the land and building), apartments are typically sold as leasehold. The ongoing reform of the leasehold system—aimed at capping ground rents and extending lease terms—is a critical development that expats must monitor to ensure the future liquidity of their assets.

Financing for the Non-Resident Investor

Securing finance as an expatriate is inherently more complex than for a domestic borrower. UK lenders often perceive non-residents as higher-risk due to the difficulty of conducting international credit checks and the potential for complex tax structures. Consequently, ‘Expat Buy-to-Let’ mortgages often carry higher interest rates and require larger deposits—typically in the range of 25% to 40% of the property’s value.

Lenders also scrutinize the source of wealth and the regulatory standing of the country where the expat is currently residing. Investors must ensure that their chosen lender is comfortable with their ‘non-domiciled’ status and that the projected rental yield satisfies the lender’s ‘interest cover ratio’ (ICR). This ratio is a stress test used by banks to ensure the rental income can cover the mortgage payments even if interest rates rise further.

Regional Disparities: From London to the Northern Powerhouse

Historically, the London market was the default choice for expatriates. However, the paradigm has shifted toward ‘regional hubs’ where the entry price is lower and the yields are significantly higher. Cities such as Manchester, Birmingham, and Liverpool are currently outperforming London in terms of capital growth and rental demand. This shift is driven by the ‘Northern Powerhouse’ initiative and significant infrastructure projects like HS2 (High Speed 2), which have decentralized the UK’s economic core.

Manchester, in particular, has seen a surge in its young professional population, driving demand for high-quality build-to-rent (BTR) developments. For an expat, investing in these regions often yields 5-7% annually, compared to the 2-3% typical of prime central London. However, regional investment requires a more hands-on approach or, more commonly, the engagement of a reputable professional property management firm to handle tenant sourcing and maintenance from afar.

Fiscal Obligations: Income Tax and Capital Gains

The UK’s ‘Non-Resident Landlord Scheme’ (NRLS) is a vital consideration. Unless an application is made to receive rent gross, letting agents are legally required to deduct tax at the basic rate (20%) before remitting the net income to the landlord. While many expats can offset this against their personal allowance or claim relief through double taxation treaties, the administrative burden remains high.

Furthermore, Capital Gains Tax (CGT) is now applicable to non-residents on the disposal of any UK residential property. Previously, non-residents enjoyed exemptions that are no longer available. This necessitates a strategic exit plan, often involving the use of corporate structures (Special Purpose Vehicles or SPVs) to hold property. Holding property within a UK limited company can offer tax efficiencies, particularly regarding the deductibility of mortgage interest, which is restricted for individual taxpayers under ‘Section 24’ rules.

Risk Mitigation and Due Diligence

Investing in a jurisdiction thousands of miles away carries inherent risks, ranging from property mismanagement to legislative changes such as the proposed Renters (Reform) Bill. This bill aims to abolish ‘no-fault’ evictions, which could impact the flexibility of landlords. To mitigate these risks, expatriates should adopt a three-pronged approach to due diligence:

1. Independent Valuation: Never rely solely on the developer’s or agent’s marketing materials.

2. Structural Surveys: Especially critical for older, secondary-market properties where hidden maintenance issues can erode returns.

3. Local Expertise: Partnering with a specialist expat mortgage broker and a tax advisor who understands both UK and the investor’s local jurisdiction is paramount.

Conclusion

UK property investment for expats remains a compelling proposition, provided it is approached with analytical rigor rather than emotional sentiment. While the ‘Golden Era’ of effortless London gains has transitioned into a more complex, tax-heavy environment, the fundamental demand for housing in the UK ensures that well-located assets will continue to provide stable returns. By focusing on regional growth hubs, optimizing tax structures through limited companies, and maintaining a robust understanding of the legal landscape, expatriates can successfully leverage the UK market to build a resilient international portfolio.