The Financial Architecture of Expat Entrepreneurship in the United Kingdom: Navigating Grants and Funding Opportunities

The Financial Architecture of Expat Entrepreneurship in the United Kingdom: Navigating Grants and Funding Opportunities

For decades, the United Kingdom has remained a pre-eminent global hub for innovation, attracting a diverse cohort of international talent seeking to transform visionary ideas into commercial realities. Expat entrepreneurs—non-UK nationals who establish businesses within the country—play a pivotal role in the British economy, contributing significantly to job creation and technological advancement. However, one of the most formidable barriers to entry for foreign-born founders is navigating the complex landscape of financial capitalization. This article provides an academic and comprehensive examination of the funding mechanisms, government grants, and private investment vehicles available to expat entrepreneurs in the UK.

1. The Strategic Importance of Foreign-Born Founders

Statistical data consistently underscores the impact of immigrant-led startups. According to various reports from the Centre for Entrepreneurs, a significant percentage of the UK’s fastest-growing companies are founded or co-founded by expats. Recognizing this, the UK government has structured its financial ecosystem to be relatively inclusive, though eligibility often hinges on residency status and the specific nature of the business visa held by the entrepreneur.

2. Government-Backed Grants and Innovation Funding

Unlike traditional loans, grants do not require repayment or the relinquishing of equity, making them highly competitive and prestigious. For expat entrepreneurs, the primary gateway to such funding is Innovate UK, the nation’s innovation agency.

Innovate UK and Smart Grants

Innovate UK offers a variety of ‘Smart Grants’ designed to support commercially viable R&D projects. These grants are open to UK-registered companies, meaning an expat must have already incorporated their business in the UK. The projects must demonstrate ‘game-changing’ potential and a clear plan for global scaling. For an expat founder, the challenge often lies in the rigorous application process, which requires detailed technical specifications and evidence of economic impact.

Local Enterprise Partnerships (LEPs) and Regional Growth Funds

Beyond national schemes, funding is often localized. Local Enterprise Partnerships (LEPs) are voluntary partnerships between local authorities and businesses. Many regions, particularly in the ‘Northern Powerhouse’ or the ‘Midlands Engine’, offer grants to attract international talent to their specific jurisdictions. These grants are often targeted at job creation in underprivileged or developing industrial zones.

3. Equity Investment: SEIS and EIS Schemes

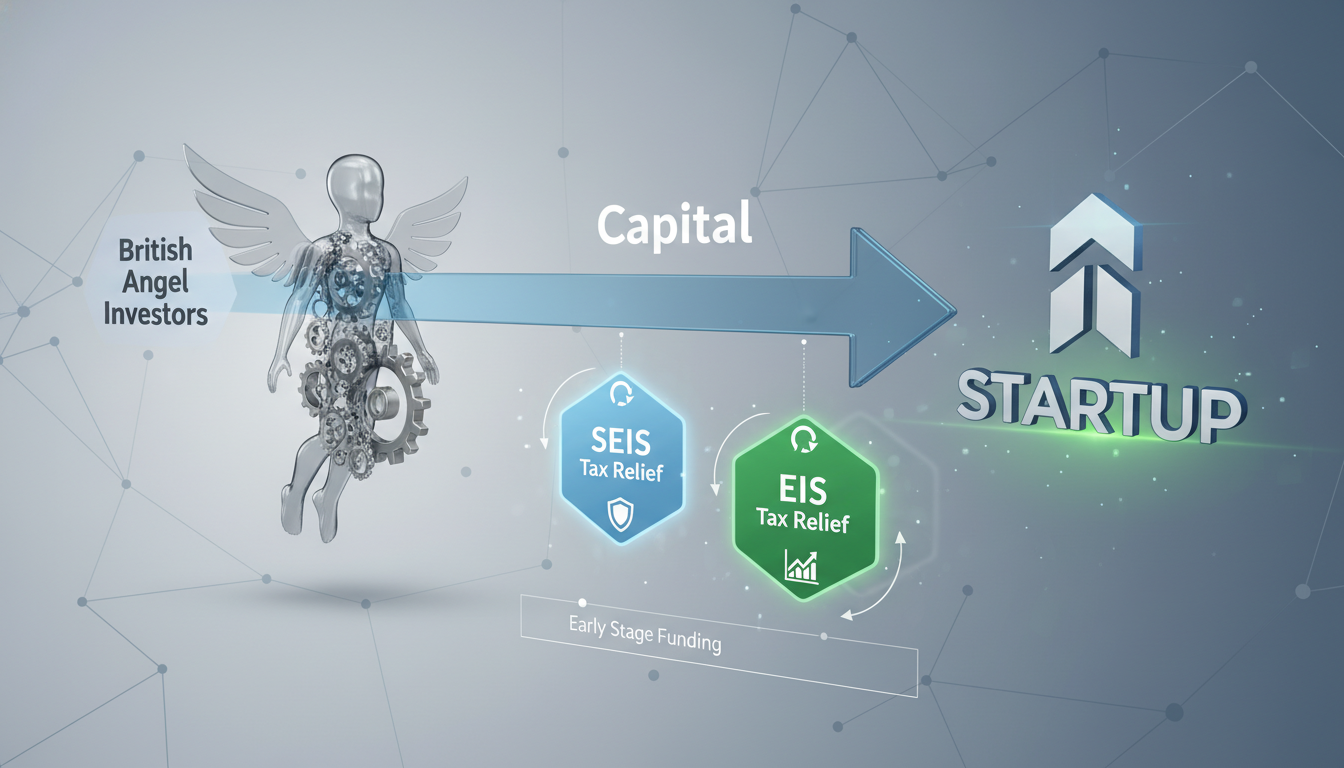

One of the UK’s most significant advantages for expat entrepreneurs is the tax-incentivized investment landscape. The Seed Enterprise Investment Scheme (SEIS) and the Enterprise Investment Scheme (EIS) are designed to encourage investment in small, early-stage companies by offering significant tax reliefs to individual investors.

While these are not direct grants, they are powerful tools for expat founders. By obtaining ‘Advance Assurance’ from HMRC that their company is SEIS/EIS eligible, expat entrepreneurs become significantly more attractive to British Angel Investors. This levels the playing field, allowing foreign founders to leverage local private capital more effectively.

4. Debt Financing and the British Business Bank

For many expats, traditional bank loans remain elusive due to a lack of UK credit history. To bridge this gap, the British Business Bank provides ‘Start Up Loans’. This is a government-backed scheme offering unsecured personal loans for business purposes.

Eligibility for Expats

To qualify, an expat must have the right to work in the UK and hold a visa that covers the duration of the loan term. While the interest rates are fixed and generally favorable, the requirement for a valid visa is a critical bottleneck for those on short-term or restrictive immigration tiers. However, the program also includes free mentoring, which is invaluable for entrepreneurs unfamiliar with the British regulatory environment.

5. Sector-Specific Funding and Research Councils

Expat entrepreneurs operating in highly specialized fields—such as biotechnology, artificial intelligence, or green energy—can tap into funding from the UK Research and Innovation (UKRI) councils. These bodies, including the Engineering and Physical Sciences Research Council (EPSRC) and the Medical Research Council (MRC), provide substantial funding for academic-spinoffs and deep-tech ventures.

The Green Economy

As the UK moves toward ‘Net Zero,’ specific grants are becoming available for sustainability-focused startups. Expats bringing expertise in renewable energy or circular economy models from their home countries are particularly well-positioned to apply for these thematic grants.

6. Challenges and Strategic Recommendations

Despite the availability of funding, expat entrepreneurs face unique structural challenges:

1. Residency Requirements: Most grants require the business to be UK-registered and for the majority of the work to be performed within the UK.

2. The ‘Credit Gap’: The absence of a domestic financial footprint can hinder access to traditional credit lines. Expats should prioritize building a UK credit score through business credit cards or small-scale financing early on.

3. Cultural Nuances in Pitching: The British investment culture often values pragmatism and realistic projections over the hyper-growth narratives common in Silicon Valley. Tailoring the pitch to the UK audience is essential.

Strategic Steps for Success

- Incorporate Locally: Ensure your business is a UK Private Limited Company (Ltd).

- Network with Accelerators: Organizations like Techstars or regional accelerators often provide both seed capital and the networking necessary to access larger grants.

- Seek Specialist Advice: Engaging a consultant familiar with Innovate UK applications or SEIS compliance can significantly increase the probability of success.

Conclusion

The United Kingdom remains one of the most fertile grounds for expat entrepreneurs, provided they can navigate the intricacies of its funding ecosystem. While the competition for grants is fierce, the combination of government-backed innovation schemes, generous tax incentives for equity investors, and specialized regional support creates a robust framework for growth. For the global entrepreneur, the UK is not just a market, but a sophisticated financial platform that, when understood deeply, offers the capital necessary to change the world.